- Solar advice hub

- Costs

- VAT on solar panels: the expert guide

VAT on solar panels: the expert guide

Learn about the UK's temporary VAT reduction on solar panels, how long it lasts for, and any exceptions.

Why you can trust our content

We know that the solar industry is full of misinformation, but we only use reliable sources, including:

- Our experienced solar experts, installers and system designers

- Our own database of solar & battery system designs

- Authoritative bodies like MCS and the UK government

Calculate savings

What kind of home do you live in?

Calculate savings

What kind of home do you live in?

VAT on solar panels: at a glance

Given how expensive going solar can be, it’s helpful that there’s currently a 0% VAT rate on solar panels and storage batteries across the UK.

Households and charitable organisations should take advantage of this discount before the rate rises to 5% in 2027 – even if the upfront cost of going solar is still too high for many customers.

In this article, we'll explain how you can qualify for the 0% rate, what the major exceptions are, and why the government took this decision.

To discover how much a solar & battery system could save you, answer a few quick questions below and we'll provide an estimate.

Find out how much you can save

What kind of home do you live in?

Do you have to pay VAT on solar panels in the UK?

There’s a 0% VAT rate on solar panels and storage batteries in the UK.

This tax relief was launched across Great Britain in April 2022, and it was then extended to Northern Ireland, storage batteries, and charitable organisations in May 2023.

Here’s a rundown of how we reached this point.

| Date | Legislation |

|---|---|

| 1 April 2022 | A 0% rate of VAT on the installation of energy-saving materials (ESMs) was introduced into law across the UK |

| 1 May 2023 | The VAT (Installation of ESMs) Order 2023 extended this 0% rate to Northern Ireland |

| 1 February 2024 | VAT Notice 708/6 (‘Energy-saving materials and heating equipment’) expanded this rule to include storage batteries and charitable buildings |

| 31 March 2027 | The 0% VAT rate on solar panels and batteries will end (more information below) |

Who can qualify for the 0% VAT rate on solar?

The 0% VAT rate applies to the purchase and installation of energy-saving materials in all residential accommodations and buildings used solely for charitable purposes, as laid out by the government’s notice. Commercial properties aren’t included.

Residential accommodations include houses, flats, care homes, hospices, houseboats, monasteries, and static caravans, while charitable buildings include village halls.

Companies constructing new builds with solar panels or other energy-saving materials can also charge 0% VAT for their services.

You can only get this 0% rate if you purchase your equipment from the same company that you use to install it.

So if you buy solar panels from one company, then hire a different firm to install them, the installation will come with 0% VAT – but the original purchase won’t.

And the 0% VAT rate doesn’t just apply to solar panels and batteries.

Qualifying products also encompass electricity-generating items like solar thermal panels, diverters, water turbines, and wind turbines, and heating-related components including insulation, heat pumps, and wood-fuelled boilers.

Is there a 0% VAT rate on storage batteries?

There is a 0% VAT rate on all storage batteries.

Batteries have been available at this 0% rate since April 2022 if they are installed at the same time as electricity-generating systems like solar panels.

And since February 2024, standalone or retrofitted batteries have also been rated at 0%.

Batteries added after a solar installation can have a large impact on the household’s savings, though it’s usually cheaper to install the entire system at the same time.

We don’t recommend getting a battery by itself though, as it’s usually an expensive process that you’re unlikely to ever break even on.

For more information, read our article about buying a standalone storage battery without solar panels.

Are there any exceptions?

If you purchase solar panels from a retailer and have them installed by a different company, you’ll be charged a 20% VAT rate.

However, most people switching to solar are unlikely to do this, and for good reason.

Firstly, solar companies train their engineers to install a set group of products, so there’s no sense in asking them to fit items they’re not familiar with.

Also, if you’re getting new solar panels, you’ll probably end up paying more overall if you buy the panels separately – and if you’re considering buying used solar panels, we’d strongly recommend you don’t, as they will have degraded over time and could even be defective.

We’d also advise against DIY solar installations, due to the safety issues, the damage you could do to your home, the possibility that your system may not work properly, and the lack of solar maintenance support – all of which means you could end up paying more in the long term anyway.

You also wouldn’t be able to sell your electricity to the grid, which is one of the major financial benefits of going solar. The savings you make by dodging installation costs pale in comparison with the money you could earn by exporting your excess electricity.

The other major exceptions to the 0% VAT rate are prisons and similar institutions, hotels, inns and similar establishments, and hospitals.

To discover how much a solar & battery system could save you, answer a few quick questions below and we'll provide an estimate.

Find out how much you can save

What kind of home do you live in?

What was the old VAT rate on solar panels?

The old VAT rate on solar panels was either 5% or 20%, depending on the situation.

Installations would come with a 5% VAT rate if they were carried out at a household with a resident who was aged 60 or over or received a qualifying benefit.

Any systems installed at a registered housing association or residences including children’s homes, care homes, and accommodation for the armed forces also used a 5% rate.

And if an installer’s hardware costs were less than 60% of the total cost of an installation, the VAT rate also dropped to 5%.

For example, if a solar company paid £5,000 for solar panels, an inverter, and a battery, then charged you £10,000 to install them at your home, this wouldn’t hit the 60% threshold – meaning the installer could use the 5% VAT rate.

Any installations that didn’t fulfil one of these criteria would incur the 20% rate.

When does the 0% VAT rate on solar end?

The 0% VAT on solar panels is set to end on 31 March 2027.

From 1 April 2027, the VAT rate is due to rise to 5%.

There’s been no move to extend the 0% rate beyond March 2027, though ultimately this decision will depend on how successful the policy is.

If the government decides in 2027 that a 0% VAT rate has prompted a rise in the installation rate of eco-friendly measures like solar panels, it may choose to keep it in order to hit the UK’s net-zero targets.

A lack of uptake could spell the end of the 0% VAT rate, but equally, too much success could convince the government that there’s no longer any need for a reduced rate.

If the UK does return to a 5% rate on solar installations – and the cost of a solar & battery system for a three-bedroom home stays at about £11,307 until April 2027 – then a household buying that system will pay an extra £565.

For more information, read our guide to solar panel costs.

The UK's first solar subscription

- No upfront cost

- Fixed monthly fee

- 20-year Sunsave Guarantee

Why did the government reduce VAT on solar?

The government reduced VAT on solar and other energy-saving measures to help reach the UK’s legally binding target of net-zero emissions by 2050.

Lowering the overall price of these products was intended to make it easier for installers and customers to afford them, and prompt an upsurge in the adoption of emission-cutting items.

The government hoped that removing barriers for companies would develop local supply chains, and that making the process easier for households would empower and enable the public in the transition to a greener, more decentralised electricity network.

In 2021, the last full year before the 0% VAT rate was introduced, residential and public sector buildings made up 18% of the UK’s annual carbon footprint – so it was worth addressing.

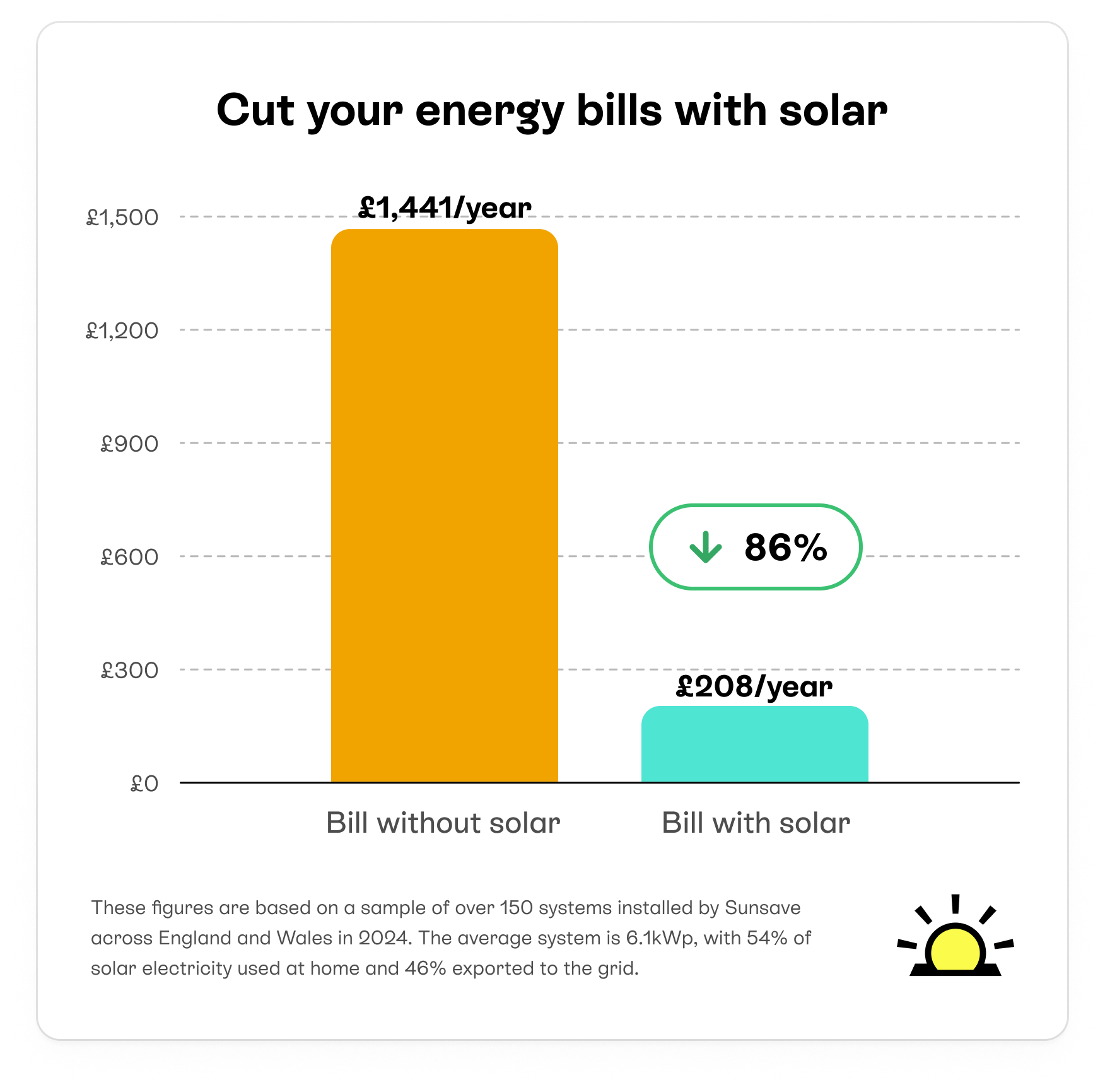

It’s also an effective way to help people lower their costs. Getting a solar & battery system can also cut your electricity bills by 86%, on average.

This figure is based on a sample of over 150 systems installed by Sunsave across England and Wales in 2024. The average system is 6.1kWp, with 54% of solar electricity used at home and 46% exported to the grid.

However, the upfront cost of going solar is prohibitive, so the VAT reduction was the government’s way of making it slightly cheaper.

Is there VAT on solar export income?

There’s no VAT on solar export income that households earn, though any VAT-registered companies with commercial solar panel systems must include a 20% rate in their sales.

You may have to pay income tax on your export earnings though, depending on your situation.

You could avoid being taxed if your system is installed at a residential property you own and occupy, and you don’t intend for it to produce substantially more electricity than you use.

This is generally viewed as meaning 20% more than your annual electricity consumption, according to the HMRC.

For example, a domestic property that uses 4,000kWh of electricity per year would have to be generating more than 4,800kWh of electricity per year to breach this threshold.

And even if your system does produce more than 120% of your usage, your export income may still be categorised as ‘trading and miscellaneous income’, which enables you to earn up to £1,000 tax-free.

Next steps

It’s worth taking advantage of the 0% VAT rate on solar panels and storage batteries before April 2027, when the rate is due to rise to 5%.

With the upfront cost of getting a solar & battery system currently standing at around £11,307, households and charities could save roughly £565 by making the move now.

You can also save more by going solar sooner, since they’ll start cutting your electricity bills straight away, and shouldn’t stop for their entire lifespan.

However, if the initial price is still off-puttingly high for you, it’s worth considering Sunsave Plus.

Our solar subscription comes with no upfront cost, and is backed up by the Sunsave Guarantee, which includes 24/7 monitoring & maintenance, free replacement parts (including a battery and inverter), and downtime cover.

Your system will also be insured by Aviva against damage, fire, and theft.

To learn how much a solar & battery system could save you, answer a few questions below and we'll provide an estimate.

Find out how much you can save

What kind of home do you live in?

VAT on solar panels: FAQs

Related articles

Written byJosh Jackman

Josh has written about the rapid rise of home solar for the past six years. His data-driven work has been featured in United Nations and World Health Organisation documents, as well as publications including The Eco Experts, Financial Times, The Independent, The Telegraph, The Times, and The Sun. Josh has also been interviewed as a renewables expert on BBC One’s Rip-Off Britain, ITV1’s Tonight show, and BBC Radio 4 and 5.