Customer focused

Our dedicated team will always be here to support you, whether you need help next month or in ten years’ time.

Sunsave is on a mission to make the power of solar accessible to all UK households

Co-founders Alick and Ben met at Oxford University in 2011, when solar panels were emerging in the UK. They had a shared interest in energy and the climate, and were fascinated by this new technology that could provide near limitless clean energy.

A decade later, they were surprised at how little solar they saw on UK roofs. The technology had improved significantly; cheaper, sleeker and more efficient. It was incredible to see how it had progressed. While researching solar for their own homes, they learned that prices were in the tens of thousands, making it unaffordable. And they discovered they weren’t alone in their thinking: 70% of UK households wanted it but only 4% had gone solar.

Meanwhile, in the US, Germany and the Netherlands, household solar had grown rapidly, driven by solar subscription models. It was affordable, offered total peace of mind and was hassle-free — a no-brainer for customers.

Taking everything they’d learned from careers in finance and entrepreneurship, they founded Sunsave in 2022 with a simple mission: make solar accessible to all UK households by launching the UK’s first solar subscription.

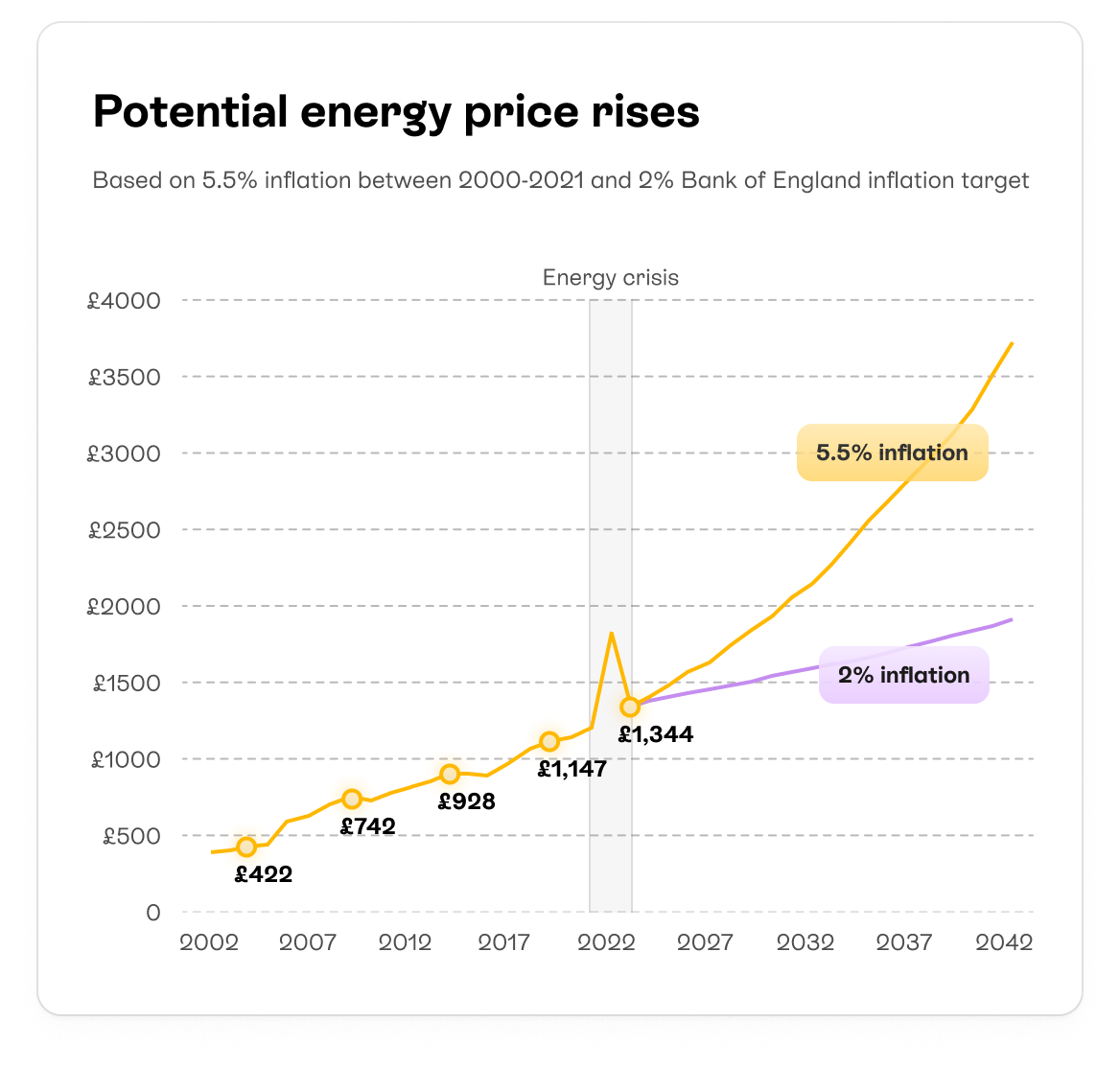

In recent years, the UK has seen just how expensive and unreliable it can be to heavily depend on gas for electricity. Nobody can predict the future, but with energy prices forecast to stay high until the late 2030s, and electricity consumption expected to increase 50% by 2035, it’s clear we’re going to need other energy sources.

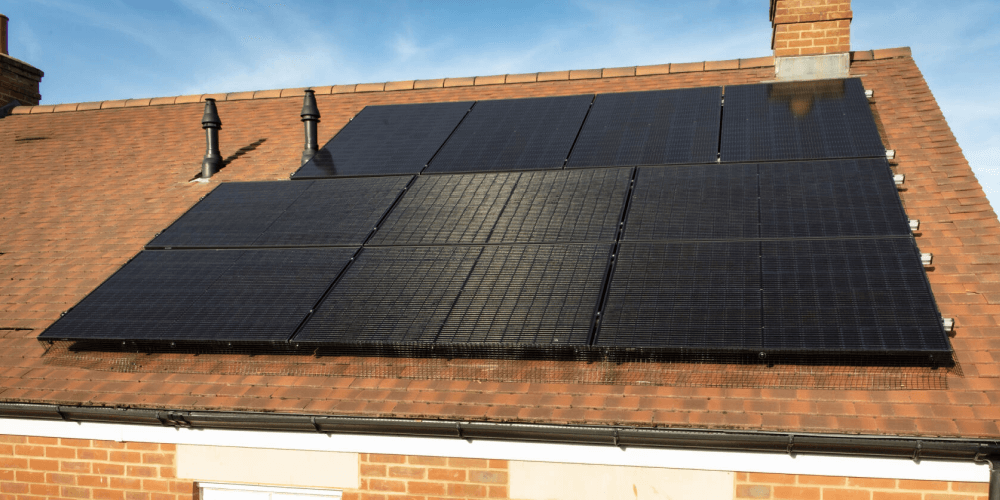

That’s where solar comes in. Panels and batteries are now cheaper and more efficient, making solar a cheaper form of energy — with the potential to free the UK from a costly and temperamental gas-powered grid. But there’s one huge problem: the average solar system costs £10,270, and half of UK households have less than £5,000 in savings.

We’ve created Sunsave Plus, which doesn’t require a one-off lump sum. Instead, it’s a subscription where you can pay for solar with a fixed monthly payment. The best part? You’ll save on your energy bills immediately.

Not only are we making solar more accessible, we’re making it simple, too. We’ve selected the best kit in the market for you and combined it in one easy package, with a 20-year Sunsave Guarantee. This kit works seamlessly together, looks great and will last for years to come.

We’ve been awarded £2.2m from the UK government via its Green Home Finance Accelerator initiative to fund the research, development and launch of Sunsave Plus.

We’ve raised over £120 million from leading venture capital funds Norrsken, Clearance Capital, and Plug and Play (which backed Paypal, Google, and Airbnb), successful angel investors like former Asda chairman Lord Stuart Rose and ICAP founder Lord Michael Spencer, and global banking group Crédit Agricole.

In 2022-2023, we raised £9.2 million from established venture capital funds that invested in Google, Airbnb, and PayPal, plus successful investors like Asda chairman Lord Stuart Rose and industry leader Bill Nussey, author of Freeing Energy.

In 2023-24, we received £2.2 million in UK government funding via its Green Home Finance Accelerator initiative. This helped fund the research, development, and launch of our solar subscription, Sunsave Plus.

In September 2023, the independent experts at Which? put us to the test and endorsed Sunsave as a Trusted Trader, demonstrating that we’re one of the highest quality solar installers around.

We were authorised and regulated by the Financial Conduct Authority (FCA) in September 2023, which allows us to offer our groundbreaking solar subscription to UK households.

In October 2023, we partnered with Octopus to help our customers access the supplier’s market-leading smart export tariffs.

We partnered with Centrica in January 2025, expanding our reach to the two million customers on the company’s Hive smart system.

We left Chinatown in Soho for the calmer streets of Clerkenwell in April 2024, before returning to Soho in May 2025 with a larger team. We’re now 40+ people strong, with decades of experience in the solar industry and leading tech companies.

In July 2025, we announced £113 million in new funding, including a £100 million facility from global banking group Crédit Agricole, and £13 million in Series A equity funding, led by Norrsken VC and IPGL. This will allow us to serve tens of thousands of homes.

We’ve got a brilliant team of 40+ people with a wide range of backgrounds. Together, we’ve spent decades in the solar industry, and have years of experience building world-changing products at companies like OVO, Monzo, and Deliveroo.

We’re driven by our mission to make the power of solar accessible to all UK households, helping them take control of their energy bills, and creating a greener future.

Interested in joining? Check out our careers page.